I just finished the book Getting to Plan B. This is hands-down the best book for a startup I’ve read in the past year. It’s got just the right balance of theory anchored by real-world examples to make the lessons stick. It’s like basic anatomy for business and it shows you how to think about the all the organ systems involved, how they function together and how tweaking one ripples effects to the others. I’ll a do a brief review/summary here for anyone who is thinking of reading it, and if you’re in a startup this should be the next thing you read.

I just finished the book Getting to Plan B. This is hands-down the best book for a startup I’ve read in the past year. It’s got just the right balance of theory anchored by real-world examples to make the lessons stick. It’s like basic anatomy for business and it shows you how to think about the all the organ systems involved, how they function together and how tweaking one ripples effects to the others. I’ll a do a brief review/summary here for anyone who is thinking of reading it, and if you’re in a startup this should be the next thing you read.

Synopsis

The core tenet of the book is that business planning is a misnomer, it’s more accurately business guessing. And companies almost never pick their destiny right on the first guess. The art of building a startup is the iterative process of zeroing in on the right formula over time. It’s all about making and testing hypotheses with empirical data rather than drafting a massive plan up front and clinging to that. If you’re familiar with software development methodologies this is the age-old “waterfall vs. agile” distinction. And this book is essentially the Agile Manifesto of business formulation that provides a creed as well as a framework for how to think about your business and conduct this iterative development.

The book is divided into two sections: the verbs and the nouns. The verbs are the processes you’ll use to hone your plan with each iteration. The nouns are the five models or “organ systems” to consider as you look at your business. First let’s look at the verbs:

The Verbs: Processes for refining the business

The ultimate goal is to zero in on the best formula for doing things that lead to the best outcome as quickly as possible. I’ll use Netflix (before it existed) as an example to demonstrate each concept.

- Find Analogues: These are the parallels you can look to in order to answer questions without doing anything other than research. The idea here is to not reinvent something that’s already been proven. Find relevant design patterns from existing businesses either in your space or better yet, in a completely different industry (because competitors likely will have already considered your adjacent players). Glean what you can from what these guys have already proven and treat it as free brickwork in building your foundation. In the Netflix scenario this might have been looking to businesses like Columbia House or BMG for proving that people were willing to purchase media mail order via subscription service.

- Find Antilogues: These are the anti-patterns to study- either the failures that have come before you or the businesses that are out there succeeding marginally but doing something wrong. Study their shortcomings and resolve to consciously do things differently. Again, this is freebie insight you get from analyzing the efforts of others – these bricks cost you nothing and allow you to work from the base of experience others have proven out rather than starting from dirt. In the Netflix scenario Blockbuster could be an analogue for its physical stores, per rental fee & late fees aspects. Another one might be Divx for how it attempted to rent DVD’s and then expire them using DRM technology. Basically anything that’s been tried and either failed or shows status quo thinking and can help you decide what not to do.

- Identify your Leaps of faith: These are the important questions left over once you’ve applied the relevant analogues and antilogues- basically the stuff that keeps you up at night wondering if it will work. Presumably you’re going to be breaking new ground- these are the do-or-die questions that will determine the viability of your proposed business. The success of your plan hinges on proving or refuting these questions as soon as you can. In the Netflix scenario some key leaps of faith: A) would people ever embrace the mailed DVD approach or would they need the spontaneity of in-store rentals? B) Would the turnaround times be sufficiently quick to provide enough liquidity and selection in the catalogue? C) Would loss or damage from postal mail as the transfer medium add costs making the service unfeasible under rates the customer would accept?

- Test them via Dashboards: These are the collections of metrics you monitor to prove or disprove your leaps of faith. For each leap of faith you determine the specific metrics necessary to test the validity of your hypothesis. For the Netflix LOF’s above some dashboards would have been: A) adoption as measured by signup rate, random surveys to determine % of movie watchers who used Netflix vs. traditional rentals over time B) avg time users held a movie, satisfaction ratings on selection quality, avg time movie was in transit C) user complaints related to loss or damage, inspection reports upon receiving returned movies.

The Nouns: The five models to consider

If you distill it all down, there’s five aspects of your business you need to refine. They’re all interrelated and tweaks to one will impact how the others function. None of this is rocket surgery when you examine them in isolation but it gets interesting when you see how changing one can allow you to play with the others for strategic advantage.

- Revenue Model: Who/what/when/where/why/how will people buy your stuff? How often? At what price? On what terms? Can you think of more meaningful ways to sell the same products under different assemblies that will increase the perceived value and allow you to charge more?

- Gross Margin Model: All about cost of goods vs. revenue – how low can you drive your COGS and how high can you kite your prices? What are the knobs you can twist on how you spend on packaging, manufacturing, delivery and sales to help your gross margin approach 100%? How can you hedge in scenarios of uncertainty using multiple product lines with mixes of different gross margin models?

- Operating Model: How can you slim down your overhead? Is it possible to transition fixed operating costs to variable in the short term so you have the benefit of that cash early and optimize for profit later? What assumptions can you challenge and what can you cut out of your offering that is non-essential and can make you a lean athlete and give you a competitive advantage in your operating model?

- Working Capital Model: Available cash as determined by Assets minus Liabilities. We all try to pay our bills at the last possible minute and collect our receivables as soon as possible but what are the real implications? How can being ruthless in optimizing this equation allow you to minimize investment required or make life difficult for a competitor? Can thin margins allow you to pass savings onto customers, create volume and allow you to negotiate better payment terms with suppliers giving you more cash on hand?

- Investment Model: the cash and other resources needed to get things started, get to break even and to then grow. How can you stage rounds of investment to increasingly remove uncertainty and therefore raise the capital you need on better terms? What can be bartered, eliminated, deferred or substituted to reduce the needed cash investment up front? What culture can you instill early on by taking a spartan approach? How much of the pie can you keep in the early stages so you can splurge on giving your employees more options and retain more control in later stages?

Takeaways

Isolate the leaps of faith and develop the metrics that test each independently: We’ve been intuitively testing hypotheses and adapting our business at JumpBox based on feedback since day one. What Plan B helped me fully absorb is the benefit of unraveling knotted hypotheses that involve multiple leaps of faith and thinking about each individually. Think of some unknown in your proposed business plan with a seemingly-straightforward question like “will people buy durian-flavored lemonade?” and I bet you can decompose it to constituent questions of “will people buy lemonade that’s a) purple b) tastes like durian c) branded with a durian fruit image on the cup? This is a simplistic/silly example but the point is the more you can tease apart the variables the better you uncover the true drivers.

Isolate the leaps of faith and develop the metrics that test each independently: We’ve been intuitively testing hypotheses and adapting our business at JumpBox based on feedback since day one. What Plan B helped me fully absorb is the benefit of unraveling knotted hypotheses that involve multiple leaps of faith and thinking about each individually. Think of some unknown in your proposed business plan with a seemingly-straightforward question like “will people buy durian-flavored lemonade?” and I bet you can decompose it to constituent questions of “will people buy lemonade that’s a) purple b) tastes like durian c) branded with a durian fruit image on the cup? This is a simplistic/silly example but the point is the more you can tease apart the variables the better you uncover the true drivers.

Think about how you can unlock more cash: The gross margin, revenue and operating models all affect your working capital model which then dictates what you need to do investment-wise. The more ways you can find to free up cash (whether by improving your gross margin, reducing operating costs, getting your customers to pay you in advance, extending terms on accounts payable, etc) the less money you have to raise and the less equity you have to give up. This of course should be common sense but the examples in the book of Costco, Go and Skype hammered these lessons home and showed how you can not only grow your own business but actually suck the oxygen out of the room for others and create impossible living conditions for your competitors.

Think about how you can unlock more cash: The gross margin, revenue and operating models all affect your working capital model which then dictates what you need to do investment-wise. The more ways you can find to free up cash (whether by improving your gross margin, reducing operating costs, getting your customers to pay you in advance, extending terms on accounts payable, etc) the less money you have to raise and the less equity you have to give up. This of course should be common sense but the examples in the book of Costco, Go and Skype hammered these lessons home and showed how you can not only grow your own business but actually suck the oxygen out of the room for others and create impossible living conditions for your competitors.

The importance of the dashboard: We already monitor key metrics in our company but Plan B hounded importance of aggregating these figures in one place and snapshotting them over time so you can see unequivocal evidence (and substantiate it to others if necessary). Traditional business intelligence systems are too heavy for most early-stage startups. But free online tools like yahoo pipes & dapper feeding a google spreadsheet can give you much of what you need. Of course if you’re slightly more technical there’s ETL and data presentation JumpBoxes that can give you even more control over your dashboard ;-)

The importance of the dashboard: We already monitor key metrics in our company but Plan B hounded importance of aggregating these figures in one place and snapshotting them over time so you can see unequivocal evidence (and substantiate it to others if necessary). Traditional business intelligence systems are too heavy for most early-stage startups. But free online tools like yahoo pipes & dapper feeding a google spreadsheet can give you much of what you need. Of course if you’re slightly more technical there’s ETL and data presentation JumpBoxes that can give you even more control over your dashboard ;-)

Sources for inspiration of analogues and antilogues I read magazines like Wired, Fast Company and Inc and I find the stories of the companies interesting but Plan B gave me a new way to think about the companies covered in these articles. It’s impossible not to start envisioning what their underlying working capital model must look like and start thinking of them as an analogue or antilogue. I love books that peel back the translucent film on life and allow you to look at something in a completely new light and see it more clearly – this book absolutely does that. It makes reading these magazines take on a new “treasure hunt” aspect and gives leisure reading a very real prospect of producing insights that can be put to work. Awesome, just awesome.

Sources for inspiration of analogues and antilogues I read magazines like Wired, Fast Company and Inc and I find the stories of the companies interesting but Plan B gave me a new way to think about the companies covered in these articles. It’s impossible not to start envisioning what their underlying working capital model must look like and start thinking of them as an analogue or antilogue. I love books that peel back the translucent film on life and allow you to look at something in a completely new light and see it more clearly – this book absolutely does that. It makes reading these magazines take on a new “treasure hunt” aspect and gives leisure reading a very real prospect of producing insights that can be put to work. Awesome, just awesome.

Critique

The only major deficiency I see with this book is that it hovers at a strategic level and never dives under the water to give truly tactical advice on how to do the dashboards. The dashboard is arguably the pivotal piece in all this because it’s how you determine if you’re right. The book has a section towards the end that helps you with “what do I do next?” but it never presents example dashboards to demonstrate how they work in practice. I would LOVE to see a paperback workbook complement to this novel. Even better, I’d like to see Komisar & Mullins team up with someone like MindTouch and include a CD complete with a functional piece of example software that shows a real dashboard referencing live data in spreadsheets, a site, a database, a CRM system, etc.

On a tangent, this is precisely the type of thing we want to enable by allowing an author to bundle working, data-filled JumpBoxes on CD with a workbook. I can easily envision including JumpBoxes for MindTouch Core, Snaplogic, SugarCRM and MySQL and then having them pre-filled with actual data and referencing Google Spreadsheets, a live web site and Excel files to show how an actual dashboard works in practice. Rather than talking abstractly about measuring nebulous things like support efficiency and sales conversion, it would be great to be able to see exactly how this works. Those physical examples would bridge the last mile here – the piece that’s missing which allows you to close the book and open up your laptop and apply dashboarding to your own situation. If the authors happen to read this, let’s talk- I’ll help you write this workbook and give you full working examples that anyone can use in minutes to play with a live dashboard in action.

Conclusion

A good book gives you theory backed by concrete, practical examples that demonstrate the concepts and emblazon them in the memory for later recall. A great book gives you this material but in a way where you can’t help but look around and start seeing the world differently. I found myself constantly thinking about other businesses and our own through the lens of these nouns and verbs. The biggest benefits to me have been to help disentangle my thinking where there are multiple leaps of faith wrapped upon one another. It’s also helped me clarify how the interplay of the various models and how deeply attaining the holy grail scenarios of negative working capital and 100% gross margin can liberate and propel a business.

Of all the books I’ve read on business and entrepreneurship, if I had to recommend just one it would be a tossup between this one and Innovator’s Solution. My head is spinning with thoughts and I feel like I’ve only retained maybe 30% of the material so I’m inclined to turn to page one and read it again. I’d say towards Eric Ries’s challenge of developing a working theory of entrepreneurship, Plan B comes about as close to a bible as any I’ve found so far.

The title is a reference to the final scene of one of the radest 80’s movies ever: “Back to the Future.” I remember walking out of that theater as a kid hopped up on red vines, Huey Lewis, the prospect of time travel, and all the possibility that a flying delorean represented. It seemed like anything was possible.

The title is a reference to the final scene of one of the radest 80’s movies ever: “Back to the Future.” I remember walking out of that theater as a kid hopped up on red vines, Huey Lewis, the prospect of time travel, and all the possibility that a flying delorean represented. It seemed like anything was possible.  I don’t have the original source on this anecdote but supposedly at a California college (Cal Poly?) they were redesigning the campus and trying to figure out where to build the new sidewalks. It was a complex arrangement of buildings and there were a bunch of conflicting opinions about where the sidewalks belonged. Someone had the ingenious idea that rather than speculating, they should instead run an experiment and let the market speak. So they planted grass the first year and waited. At the end of the year they took an aerial photo and the tread-worn ground became the blueprint for the optimal sidewalk routes as chosen perfectly and implicitly by the student body.

I don’t have the original source on this anecdote but supposedly at a California college (Cal Poly?) they were redesigning the campus and trying to figure out where to build the new sidewalks. It was a complex arrangement of buildings and there were a bunch of conflicting opinions about where the sidewalks belonged. Someone had the ingenious idea that rather than speculating, they should instead run an experiment and let the market speak. So they planted grass the first year and waited. At the end of the year they took an aerial photo and the tread-worn ground became the blueprint for the optimal sidewalk routes as chosen perfectly and implicitly by the student body.

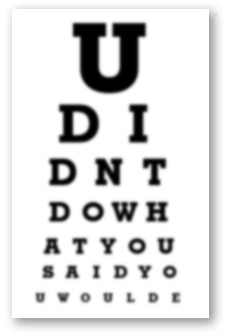

My friend

My friend

Isolate the leaps of faith and develop the metrics that test each independently: We’ve been intuitively testing hypotheses and adapting our business at

Isolate the leaps of faith and develop the metrics that test each independently: We’ve been intuitively testing hypotheses and adapting our business at